Irs 2024 Form 1041 Schedule K-1 – The federal income tax rates for 2024 remain based on the 2017 Tax Cuts and Jobs Act, standing at seven rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates work on a progressive scale, meaning . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .

Irs 2024 Form 1041 Schedule K-1

Source : www.irs.gov

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

What is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax

Source : turbotax.intuit.com

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

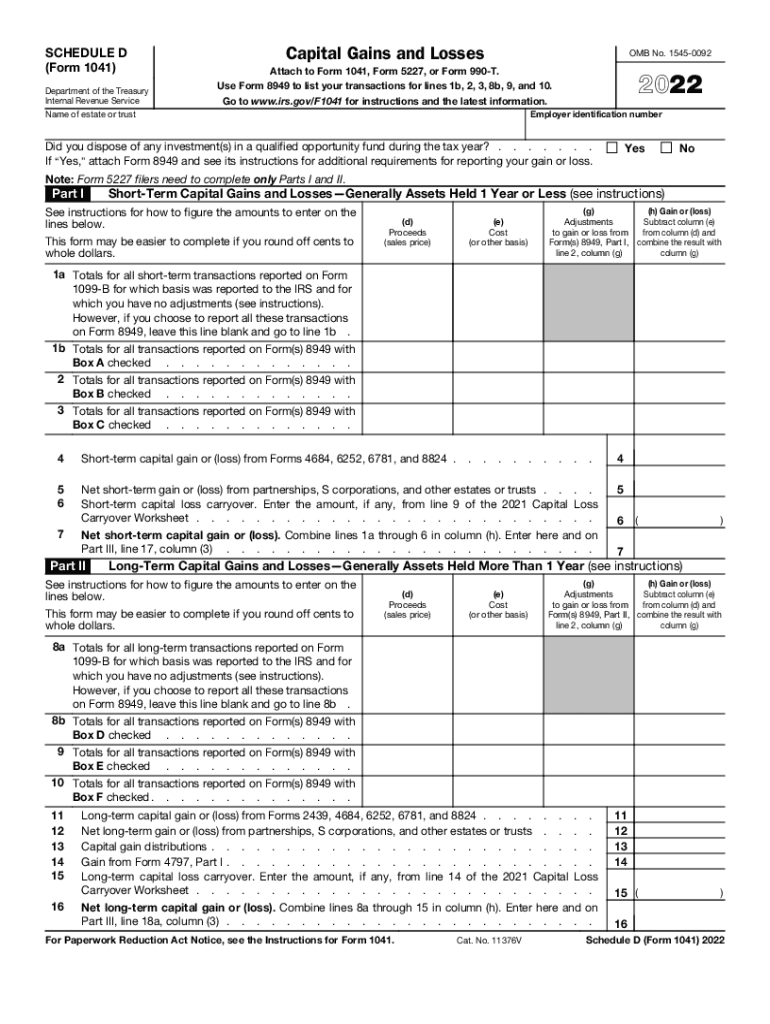

2022 Form IRS 1041 Schedule D Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.com

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

What is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

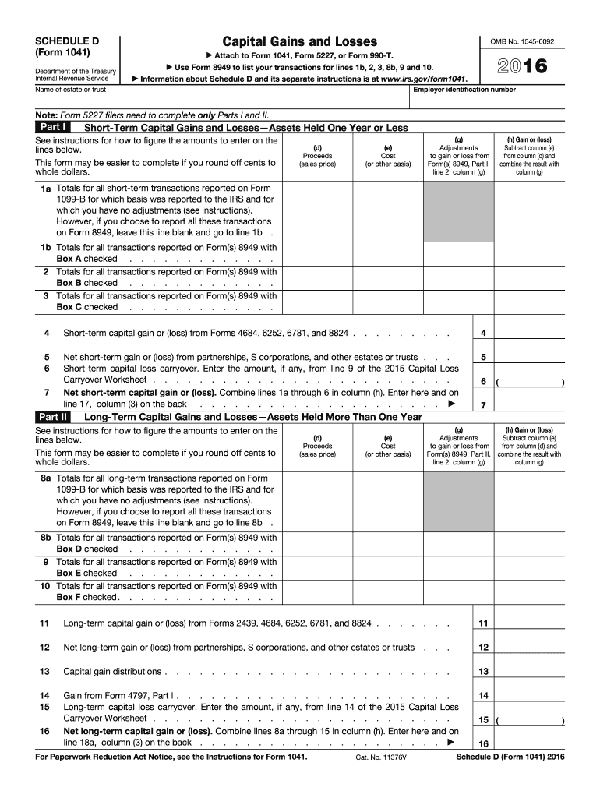

Capital Gains and Losses, IRS Tax Form Schedule D 2016 (Package of

Source : bookstore.gpo.gov

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

Irs 2024 Form 1041 Schedule K-1 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 : IRS adjusting have a new 2024 contribution limit of $4,150 for single taxpayers, an increase of 7.8%, while the contribution limit for families will increase to $8,300, or a 7.1% increase . The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which .