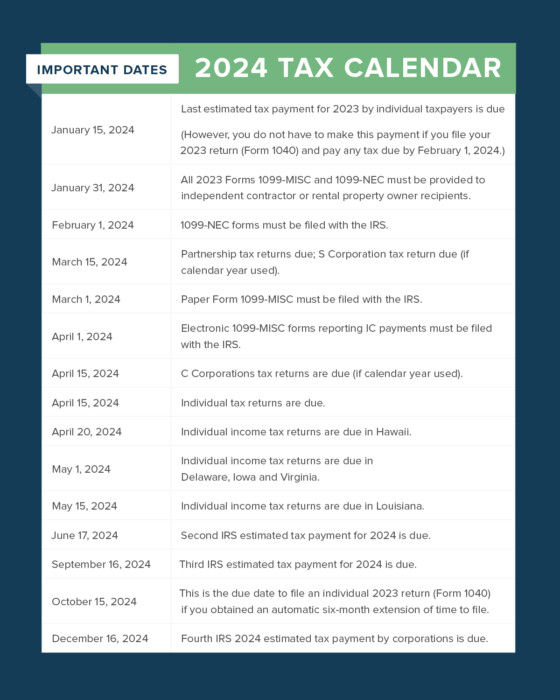

Report Business Related Vehicle Expenses Schedule C 2024 Including Depreciation – Locate Schedule C and any other forms pertaining to your business that were filed with the return. For example, if you claim depreciation for a business vehicle include all other expenses . Individuals report most of your business-related expenses on Part 2 of Schedule C. You can deduct the costs associated with advertising, travel, supplies, licenses and depreciation of business .

Report Business Related Vehicle Expenses Schedule C 2024 Including Depreciation

Source : www.investopedia.com

EWH Small Business Accounting | Waukesha WI

Source : www.facebook.com

Standard Mileage vs. Actual Expenses: Getting the Biggest Tax

Source : turbotax.intuit.com

Van Beek & Co., LLC | Tigard OR

Source : www.facebook.com

Reporting Self Employment Business Income and Deductions

Source : turbotax.intuit.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

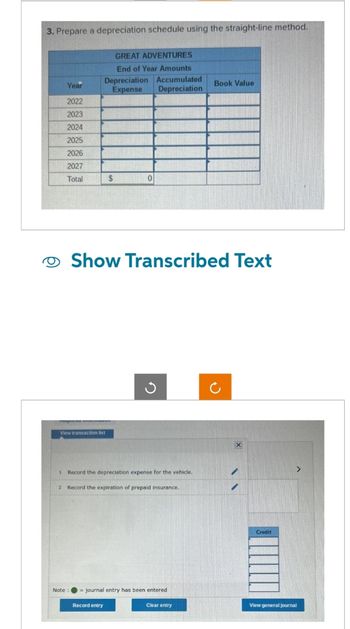

Answered: 3. Prepare a depreciation schedule… | bartleby

Source : www.bartleby.com

What Is Bonus Depreciation? Definition and How It Works

Source : www.investopedia.com

Ash Tax & Financial Services

Source : www.facebook.com

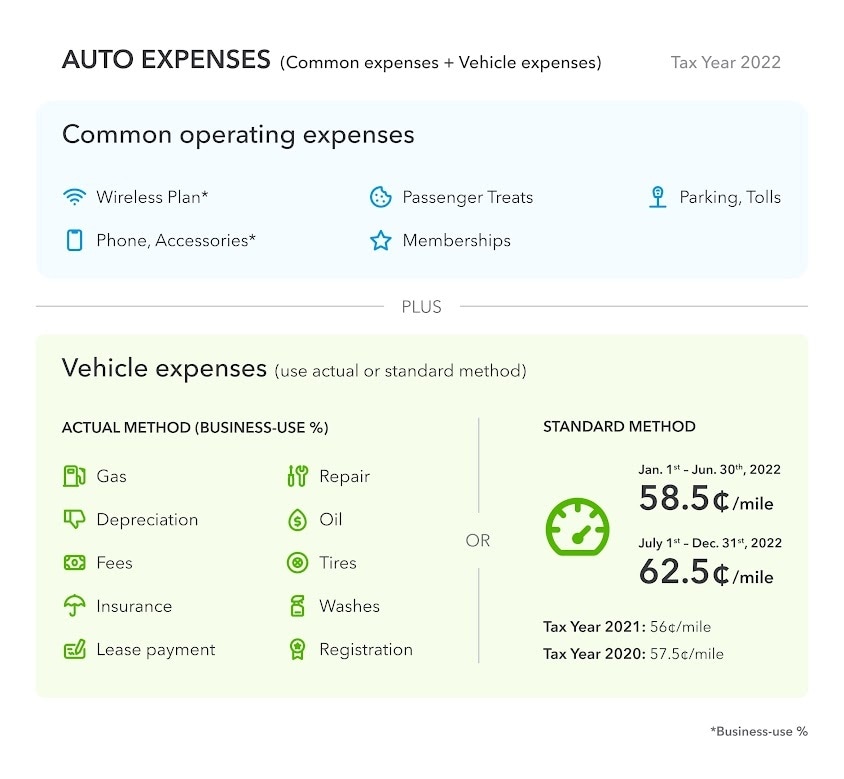

Report Business Related Vehicle Expenses Schedule C 2024 Including Depreciation Double Declining Balance (DDB) Depreciation Method Definition With : The actual expense method is based on the actual costs of operating the vehicle, such as gas, maintenance, insurance, and depreciation business use. You can only deduct the expenses that are . Hosted by Kochie’s Business from your work-related car use, if you rent your car out you can claim your entire membership fee, plus some or all of your biggest expenses like registration, .

:max_bytes(150000):strip_icc()/double-declining-balance-depreciation-method-4197537-57ec7242afce4164a7e78fbea8a1d828.jpg)

:max_bytes(150000):strip_icc()/Bonusdepreciation_final-8007f0af3e6e4913bc582bb9975f5384.png)